AI-Inflation

While PCE this morning may taste like stale crackers and lukewarm water, the number is nonetheless pivotal. For one, this number may begin to reflect AI’s impact on prices.

There is deflationary pressure in Digital goods/services, such as software and subscriptions.

Generative AI lowers production costs (coding, design, and content creation), which can reduce prices or slow price growth across categories such as SaaS, productivity tools, and creative platforms. Second, AI increases price competition.

In e-commerce and retail, the Thanksgiving holiday highlights AI-driven dynamic pricing and personalized recommendations, which increase efficiency, often leading to sharper discounting and more competitive pricing online. AI has also automated content generation, lowering marginal costs and translating into lower subscription or unit prices.

At the same time, there is inflationary pressure in compute and Infrastructure, as cloud AI services that drive demand for TPUs/GPUs and specialized chips raise costs for AI-enabled services. There is a cost to substantial energy use, as the data center expansion tied to AI increases electricity demand, which can feed into CPI categories like utilities.

AI is reshaping digital prices by making content and services cheaper, while raising costs in computing and energy.

For PCE, AI shows up in consumption weights as a reflection of more spending on AI services. In CPI, however, AI effects are seen in price dynamics, such as deflation in digital goods or inflation in hardware/energy.

For the Fed, digital, AI-generated prices will begin to matter, mainly as most of these directly affect daily necessities and thereby influence consumer inflation expectations.

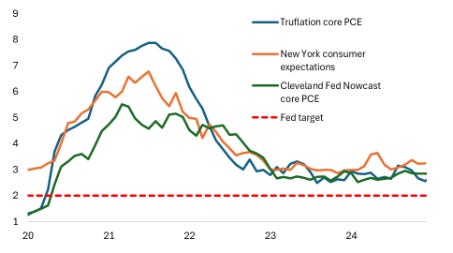

A gauge of AI-generated inflation is Truflation, an LLM-driven digital inflation metric. This measure correlates with consumer inflation expectations and the Fed’s own nowcasting of core PCE (Figure 1), and this correlation has strengthened.

Figure 1: Truflation core PCE, Nowcast core PCE, NY Fed consumer expectations (Y/Y, %)

Source: Truflation, New York Fed, Cleveland Fed

Figure 1 shows that inflation continues to anchor and oscillate in a tight range around 2.5 to 3 percent. For some Fed members, such as Hammack, this is unforgivable, and they express concern that inflation is staying too long above target, risking its persistence for a decade.

Other Fed members, like Cook and Jefferson, believe that tariff inflation is problematic, such that the next rate cuts must be done with caution, and if it sticks around, the Fed must act forcefully (Cook’s emphasis). But while that is hawkish language, the Fed has been unable to sway consumers to expect lower prices, even though AI and digital can produce deflation.

In fact, Polymarkets expects inflation to remain at 3 percent, not rise further. Nonetheless, that is ingrained inflation, and it is higher than markets are pricing in; TIPS, inflation derivatives, and CPI swaps are around 2.4 percent on average.

Figure 2: Polymarket inflation expectations (%)

Source: Polymarket

Since Williams put two words in his speech (“near term”) 2 weeks ago, the S&P energy, copper, and material indices have broken out and are up by over 10 percent. Commodity indices, CRB and Bloomberg Commodity Energy and Industrial Metals Index, are also up by 3.5 percent since.

The Treasury market is beginning to eye the inflation picture more closely again. The far longer end of the yield curve, as measured by the difference between the 30Y and 10Y yield, has been quietly steepening the last two weeks, while the odds of a rate cut shifted.

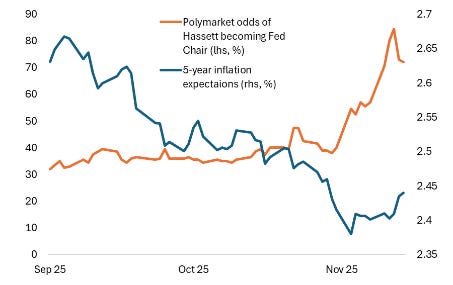

With Hassett remaining a front-runner, his Polymarket odds have fallen notably, and they have also been correlated with inflation expectations (see Figure 3).

The market is preparing for a potential rate cut that could trigger further inflation expectations, which means the Fed may not cut after December. This is the “hawkish cut,” which so far has not affected risk sentiment over the last two weeks but could do so.

Figure 3: Hassett odds and inflation expectations (%)

Source: Polymarket, CME