Community Bank Fires

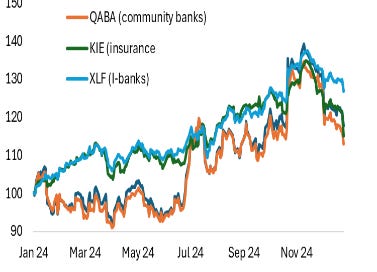

A few regional banks report earnings this week. The sector had significant momentum post-election but has faded hard in recent weeks.

The regional bank ETF, KRE, is down 5 percent year-to-date, underperforming XLF by double the margin. However, community banks are worth paying attention to. The community bank ETF, QABA, is down 6.5 percent so far and displays some signs of ‘stress’ (see Figure 1).

Community banks hold the largest share of commercial real estate (half of all outstanding CRE loans in the US). Due to their proximity to communities at high risk of wildfires and other natural events, they are more prone to climate risk (see FDIC study).

These banks hold more short-term Treasuries than regional banks, rely more on longer-maturity interest-bearing deposits (see Fed study), and have greater balance sheet concentration risk (see here).

Overall, the community banks' performance since the SBV crisis in March 2023 has been strong, but the bottom 10 banks have been down 25 to 55% since, which is about a third more than regional banks in that bucket.

With yields on the rise in anticipation of inflation, vulnerabilities in community banks may pick up, given the CRE exposures in some areas tied to natural events and their involvement in underwriting home mortgage insurance. Community bank stocks underperformed insurers by nearly 1 percent over the past week.

Figure 1: XLF, KRE, QABA and KIE

Source: iShares, SPDR, First Trust

Figure 2: 5-day Relative performance (%)

Source: Bloomberg

Still, some see value in community banks. For example, Alliance Berstein shows in their report that the average stress in community banks is lower than the national average because the size of the CRE loans is smaller, and most of the stress in CMBS is in larger loan sizes (Figure 2).

While that is true, regional and community banks’ overall performance relative to investment banks is underwhelming despite the prospect of deregulation. While most community banks are FDIC insured, the share of “brokered deposits”—higher interest and largely FDIC uninsured—has risen to 49% of their total deposit base.

Figure 2: Stress compared

Source: Alliance Bernstein

The economic fallout from the California wildfires is massive. It will likely have ripple effects on rents, inflation, and employment. California Bancorp (down 8 percent on the week) closed 60 branches in wildfire areas.

AccuWeather's updated estimate is $135-$150 billion in uninsured losses; S&P reported how these losses may result in downgrades of insurers and, ultimately, smaller banks (Figure 3).

Regional banks were the top performers in the Trump euphoria of deregulation. Yet, the Basel end-game asset threshold of $100 billion is not within the scope of many community banks. This week, larger regional banks reported that they may be at the center of attention due to rising rates and unforeseen exogenous events.

Regards,

Ben

Figure 3: Insurers at risk of downgrades due CA wildfires

Source: S&P Global