Data Center Surge

The earnings hype was too high in a Manhattan bar, so markets punished NVDA’s stock. The example shows that the market does not have an earnings problem but an expectations problem.

Interest rate expectations are also hyped and interlinked to NVDA’s stock price (Figure 1). The bond market considers NVDA a key macro factor; the company’s performance affects data center investment when demand for its GPUs and Blackwell chips weakens.

Figure 1: NVDA and Fed expectations

Source: CME, NVDA

NVDA's background story has a macroeconomic perspective, namely GDP, which was stronger than expected, especially consumption and fixed investment.

The GDP report showed that non-residential, info-processing fixed investment has accelerated by 6% since the third quarter of 2023. This area touches data centers, the production sites for AI chips.

According to the JLL data center outlook for 2024, the states with the highest solar power usage have the most data center investments. According to JLL, U.S. colocation capacity has doubled since 2020, increasing at a 21% cumulative annual growth rate, with Northern Virginia the most significant market by a factor of four.

Figure 2: Data center investment growth and power use by State

Source: JLL

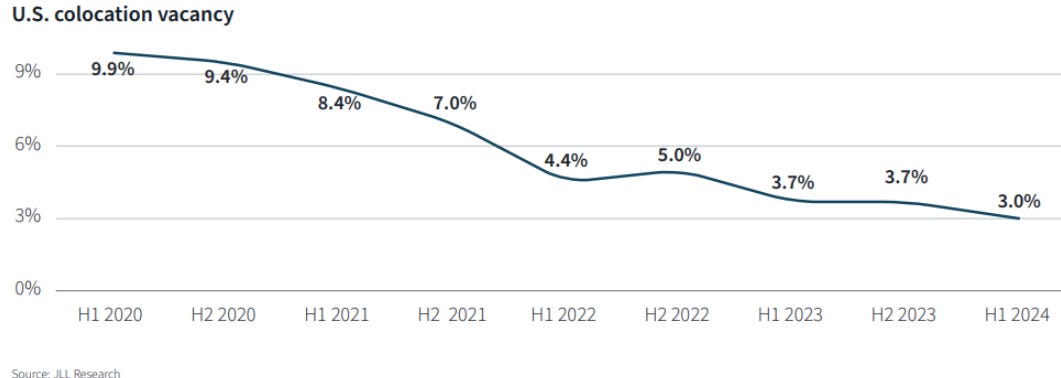

The JLL report shows a fascinating statistic: colocation vacancy. This is space in a data center that tenants do not rent.

As (power) demand and construction remain insatiable, colocation vacancy is low. It may go to zero in the next few years as nearly all new data centers must lease capacity still under construction.

Colocation occupancy, on the other hand, has been growing at a robust 30 percent CAGR over the last four years. Most of the data center capacity is leased, and 84% of the capacity under construction is encumbered, caused by cloud data center demand. The investment boom in AI data centers has legs and may affect the economy well into 2025-26.

Yet that is also the risk. If the demand for data centers and construction begins to cool, the market must digest a tremendous macroeconomic effect beyond NVDA.

For now, the data center growth is robust; the positive macroeconomic implications of the AI data center investment boom dwarf the hyped expectations around NVDA’s earnings.

Figure 3: Data center vacancy rate

Source: JLL

Figure 4: data center landscape in the US

Source: JLL