Gilt Quandary

The bond market in the UK is ablaze as traders have lost faith in the fiscal rules. The yield surge began when Chancellor Reeves's new budget included a wage hike for companies that stoked worries of stagflation.

The jump in yields ate through the fiscal buffer of ‘just’ 10 billion pounds—this is the headroom that the new Chancellor was left with after the Autumn budget—which is now about to trigger the fiscal rules.

Under that framework, the UK government must stay within spending targets or resort to cuts and tax hikes. Given the proposed wage hikes, investors worry that such hikes combined with spending cuts/tax hikes are a worse combination for the UK economy.

The pound Sterling reacted fiercely and fast, down 5 percent since early December, and the worst-performing currency YTD. The currency expresses fear of growth weakness, which is contrarily reflected in rising Gilt yields for three reasons.

The UK has twin deficits (trade and fiscal), financed for two-thirds by foreign investors. Second, specific import excise taxes make the Pound pass through inflation faster than other G10 currencies. Third, long-maturity UK Gilts have the worst liquidity of all major sovereigns due to pension/life insurers' mandated holdings of Gilts in long-term portfolios.

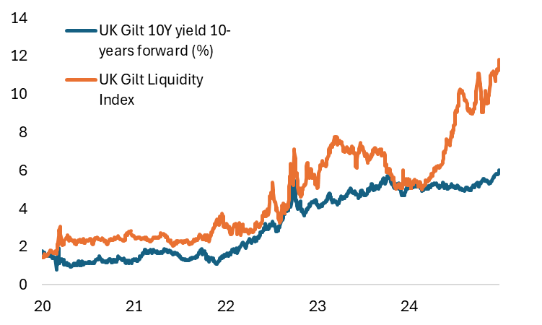

UK government bonds are engulfed in a liquidity ‘crisis’ that is worsening, as measured by Bloomberg sovereign liquidity indices. Expectations of long-term UK yields have crossed 6 percent, while the Pound's weakness is fueling the Footsie, which is up near 2% YTD, beating the S&P (Figure 1).

Figure 1: Gilt liquidity index and UK expected long-term yields (%)

Source: Bloomberg, UK DMO

Yet, the quandary in Gilts remains a blueprint for the US debt ceiling, which functions to some degree like [UK] fiscal rules. The debt ceiling negotiation will force difficult choices to tackle the spending.

However, a draconian sequestration of mandatory spending cuts for Treasuries would be reminiscent of 2011-12, when yields fell from 3.5 to 1.3 percent. The illiquidity effect on Gilts stems from a different root cause tied to US Treasuries.

The US economy is poised to accelerate due to Trump’s policy of narrowing the deficit with high growth, which, in his view, should lead to lower rates. In that context, tariffs on trading partners like the UK are essential to achieving a high, invest-led growth outcome.

Thus, Trump's trade policies are to hit twin deficit countries harder than others, especially the UK, while the US, which has the most significant twin deficit, may benefit (Figure 2).

Figure 2: Twin deficits

Source: Bloomberg MLIV, Macrobond

Gilts revisits the shades of the 1976 Sterling crisis, which forced the UK government to request a loan from the IMF. What makes the current situation worse is that Chancellor Reeves describes the sell-off as ‘orderly,’ and some speculate the Bank of England will once again step in with rate cuts.

These create credibility issues, further undermining the Pound, which is central to the Gilt liquidity crisis. The market is likely to further price in a deepening discount in UK Gilts relative to other markets, prevalent at the long-end where 50-year bonds trade at 50 cents on the dollar (Figure 3)

Figure 3: UK 50-year bond price

Source: UK DMO

For global markets, the Pound weakness can accelerate dollar strength, further adding to Jay Wood’s current corrective phase in the S&P, which looks to depart from Trump’s first-term patterns (Figure 3).

As the volatility at the index level picks up, some of the 2024 unloved sector volatility is declining (see Figure 4).

A Gilt crisis flaps its butterfly wings to the dollar, which helps a rotation gain momentum within the S&P. It reflects US economic strength and the relocation to the 2024 unloved sectors that trade at attractive valuations relative to the index level.

Figure 3: Trump Trade departure

Source: IIF/Brooks

Figure 4: S&P sector volatility versus VIX

Source: NYSE