Payrolls Challenge

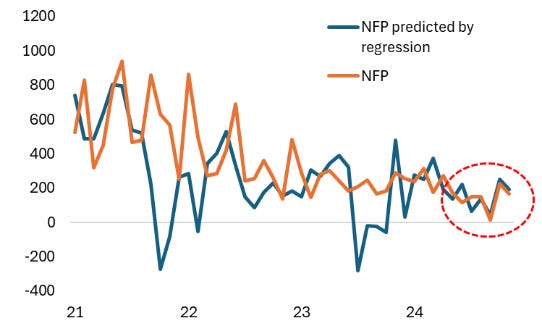

The payroll may once again be a surprise. The ingredients that have bullishly driven the growth of payrolls—--ISM, ADP, claims, JOLTS, and surveys—--point to a higher print. The Fed Watch NFP regression model “predicts” 190K based on lower quits, more vigorous leisure, construction, healthcare ADP, and services ISM employment jumping above 50 (Figure 1).

The model has a track record of predicting upside surprises. Although 190K is not massively above the median estimate of 165K, it is below the upper end of the range (268K-75K), which implies less of a surprise. Historically, when the model is 125 to 200K above the median estimate, like in April 2024 when the 10Y hit 4.75%, yields jumped (on average) by 15 basis points.

A more substantial number underscores Bowman's thinking of hawkish tone, who said in her speech that December could be the final cut because Fed policy is much closer to neutral than previously foreseen (a thought shared by Kansas Fed Schmid and St. Louis Fed Musalem).

The market remains priced for a 1.5 rate cut by the end of 2025. According to the Atlanta Fed market tracker, the probability of a hike is a small tail at 1.5 percent. If NFP is higher than 165K with average hourly earnings at 4% or above, productivity rises, translating to higher real and nominal yields.

Figure 1: NFP model versus actual NFP

Source: BLS, FedWatch

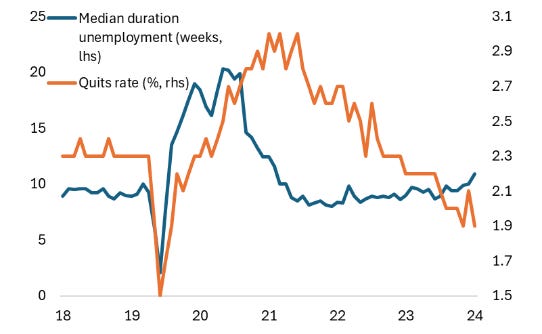

Underneath the headline strength is a labor market that continues to show weakness with structural tendencies. The WSJ highlighted that corporate layoffs have contributed to the median duration of unemployment, which stands at 10.6 weeks, and the average duration, which stands at 23.7 weeks, to find a new job.

This is partly caused by the decline in the quits rate, dubbed “the great stay” about the great resignation (see Figure 2). The erosion may cause a shrinkage of the labor force as people are no longer out of work and ineligible for jobless claims. Thus, headline payrolls may stay stronger, with the underlying trend weakening.

Figure 2: Median duration of unemployment (weeks) and quits rate (%)

Source: BLS, JOLTS

The BLS labor flows, which measure changes in the labor force, have seen a sharp decline in the ratio of “not in the labor force to employed.” In other words, people are dropping out of labor due to slow hiring and a falling quit rate environment.

This report will likely not show a material change in payrolls for federal workers. However, what is ahead could become a significant drag on the labor force as federal layoffs raise the median duration of unemployment (Figure 3). A decline in the labor force will affect productivity and wage growth.

Payroll cooling is sufficient for the Fed to keep rates unchanged. However, the rise in real yields because of productivity could increase the restrictiveness of Fed policy, reflecting an adverse strength of the dollar, which could further erode labor force expansion.

Markets are trading on mild payroll strength, but the upside surprise may be less, as seen from the decline in the whisper at 182K towards the median estimate.

Regards,

Ben

Figure 3: Federal payrolls and labor flows (not in the labor force to employed)

Source: BLS

--