Powell's Irrational Exuberance

In his 1996 speech, Greenspan said that an irrational exuberance had unduly escalated asset values, which then became subject to unexpected and prolonged contractions. He later said that the phrase came to him at a quiet moment, an epiphany.

Perhaps that is what happened to Powell when he was asked yesterday about the run-up in equities: “markets are ‘fairly highly valued,’ but that’s often a reflection of expected earnings growth and productivity gains.”

Such “fairly highly” valuation is seen in extreme examples like the Russell 2K micro-cap tech index, which looks parabolic (see Figure 1).

Figure 1: R2K Micro-cap Tech

Source: Russell

Powell’s tone is not as alarmist as Greenspan’s ‘unduly escalated, ‘ but a warning that valuations at some point may tip. Markets remain brimming with the latest string of AI-related news, such as Lithium Americas, but beneath the surface, there is a sign of defensiveness.

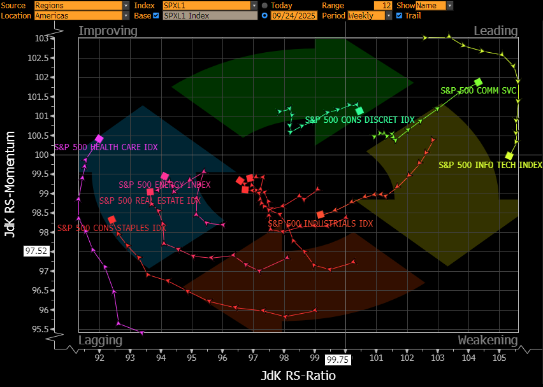

The rotation index, as measured by the “JdK RS Ratio quantifies the trend in the relative performance of a sector/security compared to the index.

Since yesterday, as Powell’s tone shifted to focus on equity valuations, the tech index has been moving into a weakening trend, while healthcare has been moving into a strengthening momentum (Figure 2).

Figure 2: Careful rotation to defense

Source: Julius de Kempenaer

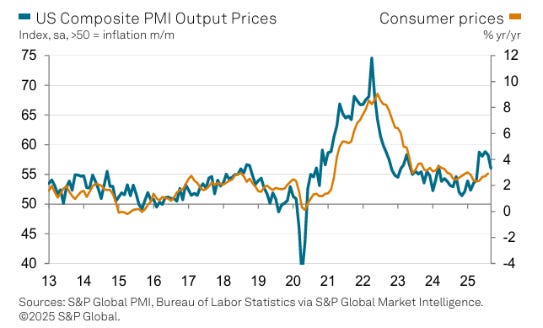

It would be a big call to say that Powell’s comment is how the equity rally will play out, just as Greenspan noted more than three years before the crash. There remains a case for accelerated upside, in part driven by AI investment following spending, and softness in consumer prices caused by inventory buildup, as shown in yesterday’s PMI (Figure 3).

In that report, the section on prices had noteworthy references to a future decline in consumer prices. There is an unprecedented buildup in inventory, forming a glut, as sales are slowing down, which is attributed directly to the microeconomic effect of tariffs.

Figure 3: PMI output prices and consumer prices

Source: S&P Global

Input costs continue to rise because exports are no longer absorbing tariffs, which are being passed on to US importers facing higher landed costs, dampening purchasing demand.

At the same time, despite a strong retail sales headline, demand is weakening because consumers are showing price sensitivity (e.g., Dollar Tree’s one-dollar store sales increased by 6.5%, compared to retail in-store sales up 3.9%).

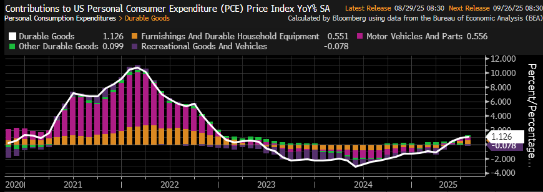

Thus, tariff pass-through in CPI is waning from 25% of the index in June to 19% of the index in August, while inventories are rising. The core PCE will still tick up, but the PPI/input-output price dynamic could show up as a dampening pressure, a first potential sign of a slowing reflation in durable (core) goods since April (see Figure 4).

Figure 4: PCE durable goods reflation

Source: BEA, Bloomberg ECAN <go>

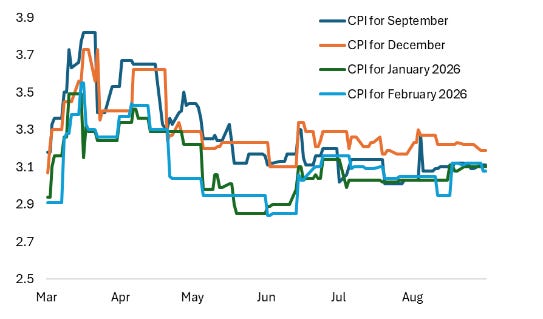

Inflation markets have been subdued since July. The 1Y inflation swap, a decent gauge of tariff inflation, has been sideways between 3.2 to 3.4%. The longer-term inflation expectations, such as the St. Louis Fed’s forward inflation and 5y5y forward inflation swap, have been confined to a tight range of 2.3 to 2.4 percent.

While the market for CPI still prices the headline to reach 3.19 percent, that is the peak, after which the tariff effect is expected to wane. This may be a complacent view, as an increasing number of foreign companies have stopped absorbing US tariffs. So, expectations for subdued inflation must be driven by a further substantial slowdown in consumer demand, which fuels equities until they are no longer “fairly” highly valued.

Figure 5: CPI expectations into 2026 (Y/Y%)

Source: DTCC