PPI Portfolio Management

Unlike the CPI index, the PCE and PPI have a component called “portfolio management and investment advisory services.” The weighting of this category is small (<1%) but relevant for how financial conditions ‘directly’ impact inflation. Another category of greater importance is energy (>30%), which has risen by 10% since the last report.

Energy and financial conditions have a reflationary relationship. When energy rises, and conditions loosen, PPI increases by 2 percent annually on average from the lows (aka “reflating producer prices”).

PPI has historically affected term premiums and yields less because of the Fed’s ‘look through’ of producer prices. But in a reflationary period, yield curves consistently steepen, and yields go higher.

Figure 1: PPI: reflating

Source: NYSE, BLS

Noteworthy, when PPI reflates, the market-implied hike probability goes up. This can be interpreted as rising producer prices, which indicate an expanding economy and feeding through to expectations (Figure 2). Consumer price expectations are well covered, and two recent surveys (NY Fed/Michigan) show anxiety about tariffs.

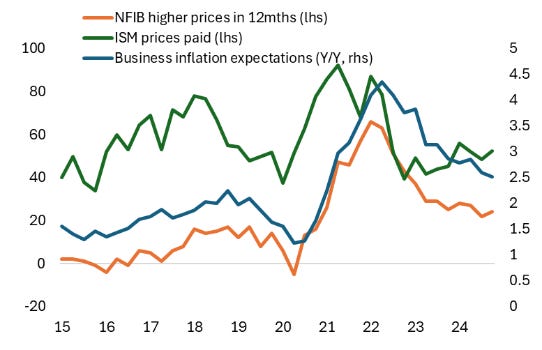

According to the Atlanta Fed, the business's inflation expectations remain modest, albeit ISM and PMI surveys show an uptick in prices paid, while NFIB price expectations have leveled out (Figure 3).

Figure 2: PPI Y/Y% and probability of a rate hike (%)

Source: BLS, CME

Figure 3: Businesses inflation expectations (%)

Source: NFIB, ISM, Atlanta Fed

However, as the NBER once reported, expectations have been de-anchored in each of these cases, and this is partisan-driven; Republicans expect 0.1% inflation, while Democrats expect 4% under Trump (Figure 4 below).

For markets, PPI now matters because of incoming tariffs affecting durable goods. Expectations of producer prices will likely have a more considerable weight in calculating the Fed’s subsequent actions and the economy's direction considering a massive rebuild in California, which can affect producer prices.

Yields are higher in anticipation of a stickier, higher print of (core) PPI. While PPI has been leading in the past in coming deflationary/disinflation due to its high weight of energy and commodities prices, the current episode is a reflation driven by a combination of portfolio management and energy. PPI-linked ETFs, e.g., PPI, XLE, stand to benefit.

Regards,

Ben

Figure 4: Partisan inflation expectations

Source: University of Michigan

--