Shipping Reflation

On a post-Powell hangover day, market trepidation about NVDA and Middle East tensions may have taken the shine off the rally. Underneath is a trend that keeps the stock market at the bedrock of a steady state.

Since the summer of 2022, when CPI peaked, the 10Y yield and oil prices have been closely related. Treasury yields reflect the disinflation in CPI caused by the $40 decline in energy prices since the middle of 2022. On the other hand, oil prices have been declining due to lackluster demand.

The tight relationship between rates and oil has allowed markets to roam freely. Yields rising when energy prices rise is about good news; conversely, when each decline is about bad news (about the economy).

At the current low of the range, yields and oil have scope to rise in tandem, then good news = good news will dominate sentiment.

Figure 1: 10Y yield and oil prices

Source: NYMEX, Tradeweb

Oil prices have a unique effect on financial markets. A rise in energy prices is associated with geopolitical tensions or “reflation,” a recovery in consumer prices due to demand. Tensions in the Suez Canal and escalation between Israel and Hezbollah have put pressure on container shipping rates due to the lengthening of routes and delivery times.

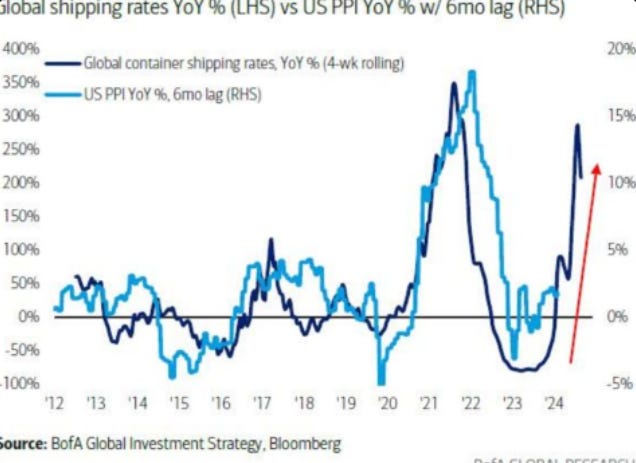

PPI and shipping rates have been in lockstep on a 6-month lagging basis. A new inflationary impulse is building and rising shipping rates that tighten the relationship between oil prices and Treasury yields.

Container shipping rates, on average, rise six months ahead of a potential rise in yields and oil prices. The shipping rates wrapped up 5.5 months of a steady rise while yields and oil declined.

Figure 2: PPI and Shipping Rates

Source: Bank of America

Regarding shipping rates, shippers have been working hard to advance the demand for containers in anticipation of Red Sea disruptions and the rising threat of new strikes at US ports. Container volume is up 6.3% year on year, and volumes from Asia to the US, which account for 14% of total volume, saw a significant surge in June-July.

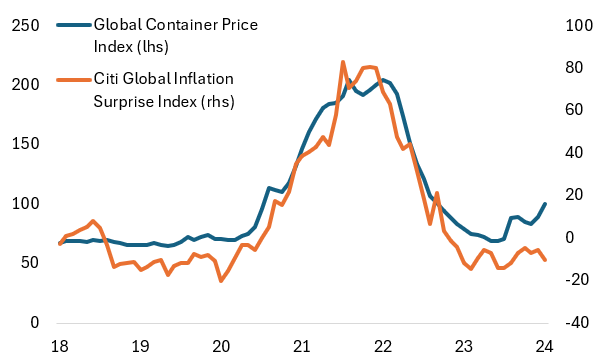

Container volume growth could accelerate as Southern California ports have significantly increased inbound traffic (+61% and +38% in Long Beach and LA). These developments have added upward pressure to global container prices, while global inflation surprises have been negative (Figure 3).

While it is somewhat premature to call an end to the disinflation that has supported economies and markets the last two years, the reemerging pressures and frictions in supply chains and shipping items could slow disinflation to a stall right at the moment the Fed and others kicked off the easing cycle. While rising oil and yields = good news is good news, frictions driving a "shipping rates reflation" can add pressure to global inflation.

Regards,

Ben

Figure 3: Container Price Index and Citi Global Inflation Surprise Index

Source: Citi, CTS

Supports the thesis that while it may be time to adjust, one should adjust in a cautious and calibrated fashion.