The Curious Balance

At last week's press conference, there was a notable point Powell made about the jobs market.

He estimated that the non-farm payroll “break-even rate,” the cumulative annualized growth rate of payrolls to keep the unemployment rate stable, is between zero and 50,000. Just a few months ago, as Powell said, it was between 150,000 and 200,000.

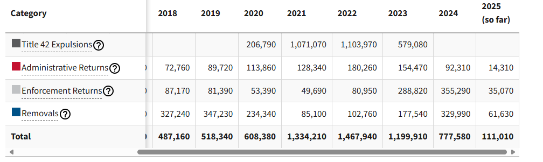

That is a substantial drop, which is caused by far fewer people joining the workforce, a significant source of labor supply over the last three years. A reason could be a decline in net immigration, which Homeland Security data shows has been going on since 2022 (Figure 1).

It may be a factor that explains the US labor force's anemic annualized growth of 0.4 percent since 2020, and now the latest news of H1B visa fees adds a new twist.

Figure 1: Labor supply factor: repatriation of immigrants

Source: Homeland Security

The H1B visa developments could also affect future payroll. Since 2020, H-1B visa holders have contributed an estimated 90,000–150,000 net additions to U.S. non-farm payrolls, based on Labor Condition Application (LCA) filings and USCIS approval data.

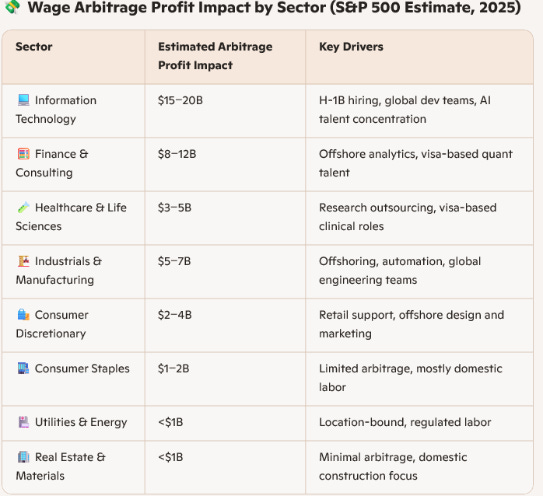

While current visa holders, 2025 lottery, and renewals are exempt from fees under current guidance, what could be particularly disrupted is "wage arbitrage."

This is leveraging differences in labor costs across geographies or labor pools to reduce expenses and boost profitability. The future impact on profits could be material, especially in the Tech and Finance sectors.

Figure 2

Source: FactSet, S&P

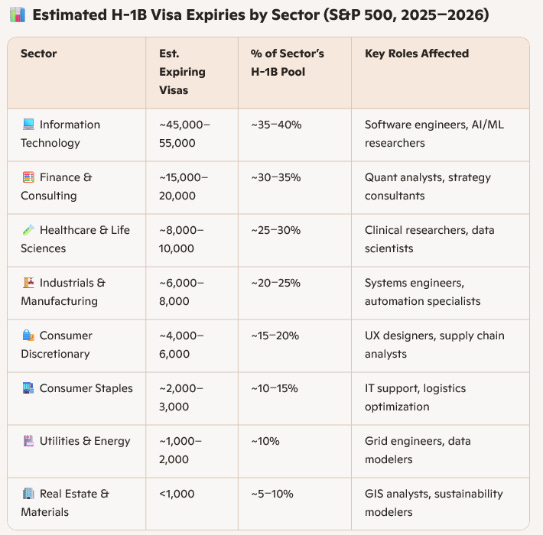

Those sectors are expected to see the largest H1B visa expiries, estimated at up to 40% of the total workforce by 2026 (Figure 3). These estimates reflect visas issued in 2022–2023 that are set to expire in 2025–2026, assuming standard 3-year durations and no early exits or renewals.

As the current guidance on H1B visa fees may change, labor supply could be affected potentially more, resulting in a faster pace of decline than the fall in labor demand.

Figure 3: H1B visa expiry by sector and % of workforce

Source: DOL, Homeland Security, Bureau of Naturalization

Powell noted in the press conference that the decline in labor supply and demand has been “speedy” and synchronous, which “has certainly gotten everyone’s attention.”

It has created a curious balance between supply and demand of labor, which is getting more coverage in Fed research. Typically, this is a sign of influence on the Fed’s reaction function as Fed staff research is incorporated in committee deliberations.

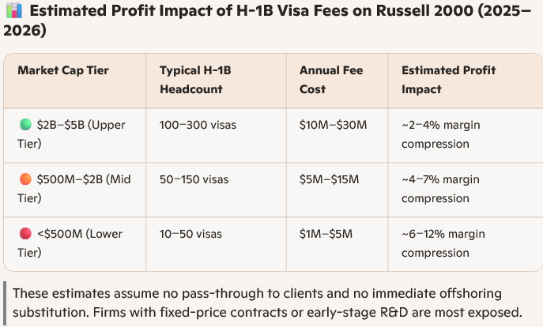

Initially, there could be a modestly adverse reaction in the stock market, specifically for small-cap tech companies that have less absorption of visa fees costs than the big-Tech companies (see Figure 4). For example, small-cap Biotech & Deep Tech Startups often hire specialized talent via H-1B and operate on thin margins. A $100K fee per hire can rival their annual equipment budget.

As the curious balance of labor supply and demand converges at this stage of the cycle, they will increasingly dominate over other macro data (as Powell noted) and determine market direction.

Regards,

Ben

Figure 4

Source: Russell