The Yen Put

The overnight news that Japanese officials are meeting to “discuss the Yen” indicates how this liquidity crisis will play out. The Yen at the center of gravity determines how many rate cuts will be left priced in after the dust settles.

Previously, the Japanese government's jawboning had little effect on the Yen. The currency market butter knifed significant resistance on the upside. However, on the downside, there is considerable scope for a rebound in the Yen, and Prime Minister Kishida soft-sounded the “Yen put:” “I closely watch with a sense of urgency while cooperating with the BOJ.”

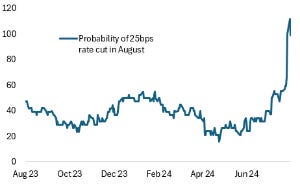

Figure 1: Yen and Fed Rate Cuts

Source: MoF, BOJ, WIRP

While the “Yen put” may have been initiated, it's clear that more action is required to be truly effective. The market is actively calling for an emergency inter-meeting cut, with the current probability at a significant 101% based on August Fed Funds futures, which settle right after Jackson Hole (Figure 2).

For an actual reversal of the current dynamic, the Yen must break 148 at the upside, reducing the inter-meeting rate cut probability by more than half. Should the Yen's jawboning become ineffective, the Fed could assist. The Fed has a standing USD swap line with the BOJ that can be activated at any moment; the Fed adds dollar liquidity through a swap for Yen from the BOJ, which could significantly stabilize the Yen.

Figure 2: the probability of an inter-meeting cut (%)

Source: CME

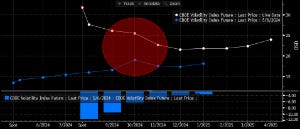

A consequence of the Yen turmoil is the material shift in the VIX. The curve inversion (spot VIX higher than futures) has removed the spike around the election (Figure 3). The market sees the election uncertainty being front-loaded while the BOJ’s path to more hikes has unhinged the Yen, affecting the VIX, the yield curve, and Fed expectations.

The fear gauge hit 65.73 intra-day yesterday. Right when Goolsbee spoke at 8:30 a.m. ET, the VIX peaked (ahead of a better-than-expected services ISM), which signifies a market looking for official intervention from the Fed and the BOJ.

Typically, a dis-inversion of the VIX curve is a bullish signal. The VIX cannot normalize back into the 15 to 20 range this time unless the Yen trades well above 150 to the dollar.

Given the short positioning in Yen futures by levered funds and asset managers, it has barely changed by just a 5% decline in open interest; the VIX curve will remain inverted to reflect heightened uncertainty about the US election, the Yen, and the Fed’s next step all tangled up.

Figure 3: VIX Curve vs. three months ago

Source; CME

Rather than screaming for an inter-meeting cut, the market trades “the Yen put” more. The tentative stabilization of a 10% rally in the Nikkei, six basis points rise in the 2Y yield, and short VIX ETFs up 20%, while the Yen is up 2% from the lows, suggesting that the market wants an intervention in the currency.

Most evident is the way credit spreads ‘widened.’ It was the most moderate widening of High-Yield spreads in the history of VIX spikes. While High-Yield is a distinctive asset class with random, opportunistic issues and significantly lower leveraged primary energy and telecom issuers, the HYG ETF and High Yield CDX are liquid trades in the sector.

The dislocation between spreads and VIX means that High Yield will not catch up with volatility unless macro factors drive the yield curve bullishly steeper, i.e., the 2Y yield falls to 3 percent and below. With the “Yen put” lurking, there is more scope for emergency rate cuts to be removed to just one cut for 2024. If that process unfolds, the potential for a US stock rally, seen in the Nikkei overnight, becomes incrementally higher.

Figure 4: High Yield spreads and VIX

Source: CME

Thanks for sharing, great insights and valid summary.