Waller's Term Premium

During Q&A after his speech, Chris Waller explained why long-term yields and term premiums have risen.

He pointed to persistent inflation concerns and worries that prices may increase, which require an inflation risk premium expressed in yields. He was brief on how the Fed sees that issue: “We’ll fix that problem, so don’t worry about it.” That is an implicit hint to an interest rate hike, which could partly explain the rise in the term premium.

Notably, he said there is concern about fiscal deficits because of $2 trillion of borrowing. If that did not change, the market would demand compensation with a [fiscal] risk premium. To Waller, fiscal deficit concerns are what primarily drive yields.

Then, he touched on productivity and tariffs. He does not expect draconian tariffs to be implemented (perhaps because of his political views), but he does see productivity rising from lagged effects.

Such disruptions of employment and subsequent investment in worker training and new business creation are now showing up in productivity even before signs of AI are visible in worker productivity.

In his speech, he argues that rising productivity is associated with a higher value of r*, the neutral rate, which has implications for interpreting how accommodative or restrictive Fed policy is.

These three premiums—inflation, fiscal deficit, and neutral rate—have been behind the move in term premiums since early December.

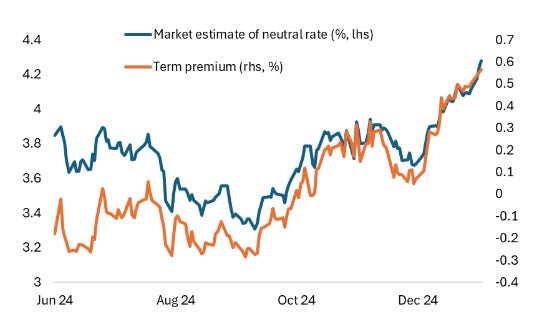

The neutral rate is driving the term premium the most, which the market is pricing at 4.25% currently, the highest since 2007 (see Figure 1). The inflation and fiscal risk premiums have risen since December (see Figure 2 below).

Figure 1: Term premium driven by neutral rate (%)

Source: NY Federal Reserve

Waller may have preempted the FOMC Minutes by emphasizing that the Fed controls inflation while tariffs do not matter as much in the context of price increases.

At the same time, the neutral rate is in flux because productivity may rise, which is linked to the fiscal deficit staying large. The fiscal deficit is the key funding source for investment and affects productivity.

The FOMC Minutes may be ‘dovish’ regarding the prospect of a rate cut(s) remaining alive but could be ‘hawkish’ regarding the prospect of GDP rising due to productivity.

The Fed sees that as a strong case for removing more restrictions from the policy rate. The bond market, however, wants compensation because such a policy can raise potential output and inflation, which can worsen the deficit.

Regards,

Ben

Figure 2: Inflation and Fiscal risk premium rising (%)

Source: CME, CBO